Is Buying Real Estate Leads Worth It? Complete Costs & ROI Breakdown

As a real estate investor, one of your most important jobs is figuring out how to consistently generate quality leads without breaking the bank. So logically you ask yourself is buying real estate leads worth it?

Real estate investor lead generation has evolved dramatically, presenting both opportunities and challenges for those willing to invest.

While some investors swear by traditional methods like direct mail and cold calling, others find their sweet spot in digital channels such as SEO or pay-per-click advertising.

But here’s the reality: successful lead generation isn’t just about the dollar amount you spend—it’s about understanding the complete cost structure, including your time investment, marketing overhead, cash-flow, and the long-term ROI of each channel.

Before you allocate your resources to any lead generation strategy, you need a clear framework for evaluating not just the upfront costs, but also the true return on investment when accounting for conversion rates, deal quality, and scalability potential.

How Much Do Real Estate Leads Cost?

Unfortunately, the answer is it depends.

But let’s break down what variables go into a question like this so you can be more educated in understanding what the true cost of a lead is worth.

Based on some assumptions – you could spend up to $150 per lead if your average wholesale transaction is $10k and you convert leads at 4.5% and want a 300% ROI.

Targeting 300% ROI gives you flexibility and scalability. You don’t want to run on razor-thin margins because some months won’t go as planned and you might spend $200 per lead and convert at 3%.

Also, it’s important to remember that a lead generated in March might close in June…so you need enough in the bank to withstand months of no revenue until you close your next deal.

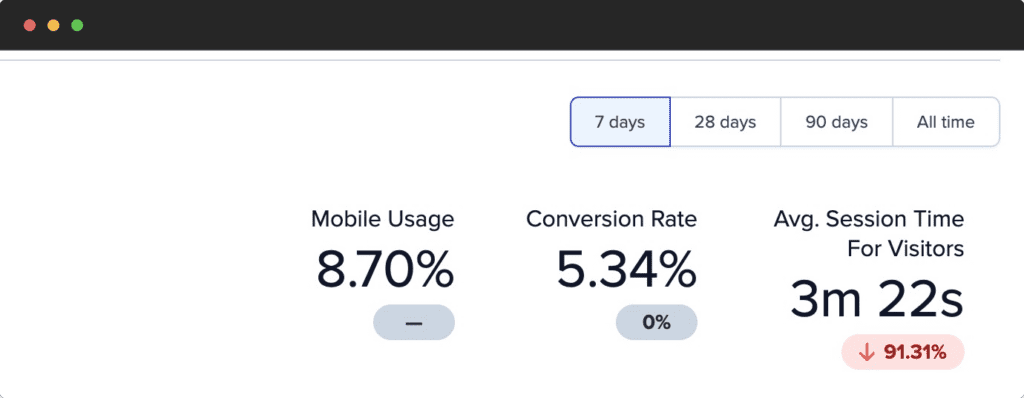

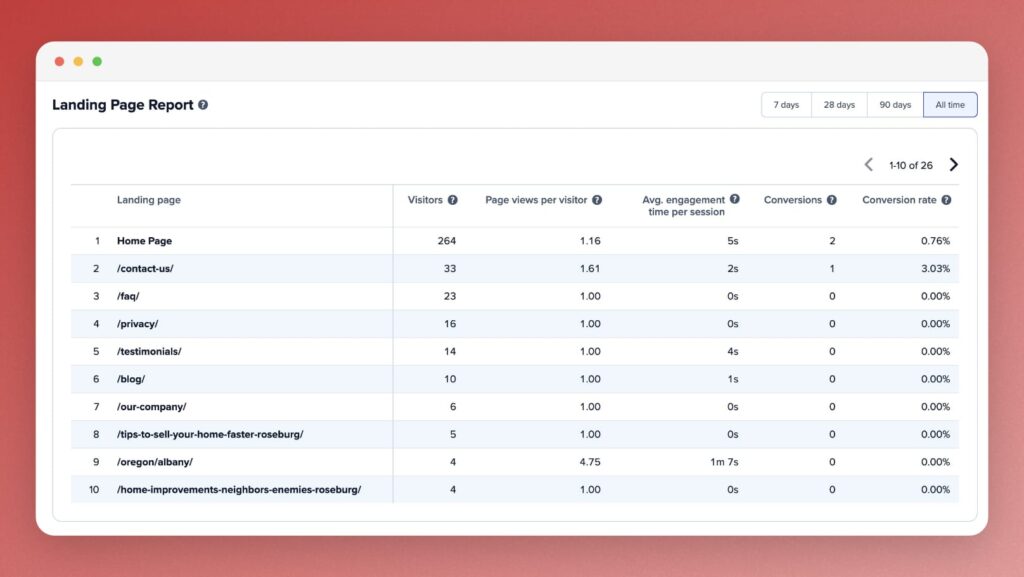

Not sure how to find your conversion rate? Carrot website’s analytics make it dead simple. Just login and you can find your overall conversion and a breakdown by page.

Let’s Breakdown Common Lead Generation Methods

This isn’t a fully comprehensive list. But we are going to break down the costs and assumptions that go into the most popular lead generation strategies. I would strongly recommend you only focus on one of these at a time. Once you have your metrics dialed in you can add more strategies to your mix.

CAUTION: Avoid shiny object syndrome – it’s super common for real estate investors.

Pay Per Lead Real Estate Leads

The pay-per-lead model has become increasingly popular among real estate investors, with companies like PropertyLeads.com, Zillow Premier Agent, and Market Leader dominating the space. These services typically charge between $20-100 per lead, with qualified leads on the higher end of that spectrum.

Key considerations:

- Most pay-per-lead services operate on a 20-30% contact rate

- Average conversion rates hover between 1-3% for cold leads

- Exclusive leads typically cost 2-3x more than shared leads

- Monthly investment requirements often start at $500-1000

Real Cost Analysis: For every 100 leads at $50 per lead ($5,000 investment):

- 5-20 leads will typically result in an actual contact

- 1-3 deals might close from this pool

- Cost per acquisition: $1,667-$5,000 per deal

⚠️ If your average wholesale assignment is on the lower end ($5k) then this strategy might not have enough margin for it to scale for your market.

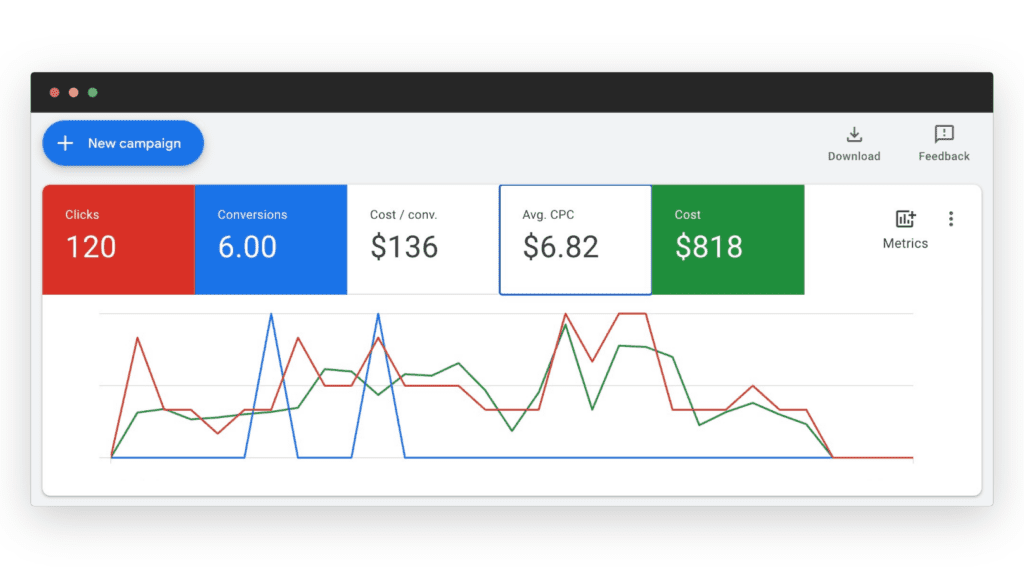

Google PPC Real Estate Lead Costs

Google Ads remains one of the most competitive channels for real estate lead generation, particularly in highly populated markets (think Houston, Orlando, etc).

PPC lead generation is a great strategy for anyone in a smaller market who has a moderate marketing budget and wants to be focus on building a brand and have a high-converting website.

Current market metrics:

- Average cost per click (CPC): $2-$50

- Lead conversion rate: 2.5-5%

- Keywords like “sell house fast” often exceed $20 per click in competitive markets

- Geographic targeting significantly lowers costs

Cost Breakdown:

- Monthly budget: $2,000

- Average CPC: $8

- Clicks received: 250

- Leads generated (3% conversion): 7-8

- Cost per lead: $250-$285

I’ve seen Google Ads work EXTREMELY well for real estate investors in what I would call mid-sized markets. Think places like Kansas City, Montgomery Alabama, etc.

This could be a strategy you use in a smaller market while you focus on a larger market for strategies like direct mail or PPL.

SEO Real Estate Lead Costs

SEO represents a long-term investment with compounding returns, but requires significant upfront investment and patience.

Initial Investment Range:

- Professional SEO services: $1,000-$3,000/month

- Content creation: $500-$1,500/month

- Technical optimization: $1,000-$2,000 (one-time)

Timeline expectations:

- 3-6 months: Initial ranking improvements

- 6-12 months: Significant lead generation begins

- 12+ months: Peak performance and ROI

SEO is far and away the highest ROI marketing strategy on this list. But it’s complicated and requires a consistency and tenacity that frankly most real estate investors won’t commit to. If you have a lot of time on your hands and are okay with waiting 5-6 months to close your first deal – this is the strategy I would recommend for you.

Driving For Dollars Real Estate Lead Costs

This traditional method has been revolutionized by technology but remains labor-intensive.

Modern D4D costs:

- App subscriptions (DealMachine, PropStream): $50-150/month

- Fuel costs: $0.65/mile (IRS rate)

- Labor cost (if outsourced): $15-20/hour

- Skip tracing: $0.25-$1 per record

Typical Monthly Investment:

- 40 hours of driving

- 200 properties identified

- Skip tracing costs: $50-200

- Total monthly investment: $750-1,200

Again, I’ve seen plenty of Carrot members have success with this strategy but it DOESN’T scale. There are only so many houses you can drive by month after month before you can’t grow your marketing. Also this is OUTBOUND meaning you are soliciting your services to people who may or may not be interested. Compare that to INBOUND (PPC and SEO) where people are coming to you for a service.

Direct Mail Real Estate Lead Costs

Direct mail remains effective but requires careful targeting and consistent follow-up.

Current cost metrics:

- Postcards: $0.30-$0.75 per piece

- Letters: $0.75-$1.50 per piece

- List costs: $0.10-$0.30 per record

- Average response rate: 1-3%

- Average conversion rate: 0.1-1%

Campaign Example: 1,000 piece campaign:

- List purchase: $200

- Design and printing: $750

- Postage: $400

- Total: $1,350

- Expected responses: 1-30

- Potential deals: 1-2

Direct mail isn’t going anywhere – no matter what YouTube guru tells you different. Again it’s outbound marketing and it’s just a numbers game. This strategy works well in larger markets with a lot of mailboxes to send your mail to. The other challenge with this strategy is tracking conversions. You have no idea who is reading your mail, throwing it away or uninterested.

If you go the direct mail route – PLEASE include a website URL (not your home page but a landing page) so you can track how many people check out your website after getting your direct mail.

Is Buying Real Estate Leads Worth It?

The ROI calculation depends on several factors:

- Market Variables:

- Average deal profit in your market

- Competition level

- Population density

- Market velocity

- Operational Efficiency:

- Lead follow-up systems

- CRM implementation

- Team response time

- Lead nurturing processes

- Financial Metrics to Consider:

- Cost per lead

- Cost per acquisition

- Marketing overhead

- Time investment

See How Much You Can Pay Per Lead

Find what the right CPL is for your marketing expectations and budget

Decision Framework:

- Calculate your maximum allowable lead cost: Copy

(Average Deal Profit × Expected Conversion Rate) ÷ Desired ROI = Max Cost per Lead - Factor in your operational capacity:

- How many leads can you effectively follow up with?

- What’s your current closing ratio?

- Do you have systems in place to nurture leads?

- Consider your market position:

- Are you established or just starting?

- Do you have testimonials and proof of performance?

- What’s your unique value proposition?

The Verdict: Buying Leads Can Be Worth It If…

- You have strong follow-up systems in place

- Your market can support the necessary margins

- You can maintain consistent lead flow

- You have the capital to sustain campaigns through optimization